The Journal Entry to Record Labor Costs Credits

In each case the job cost accounting journal entries show the debit and credit account together. The journal entry to record incurred direct labor would include a credit to.

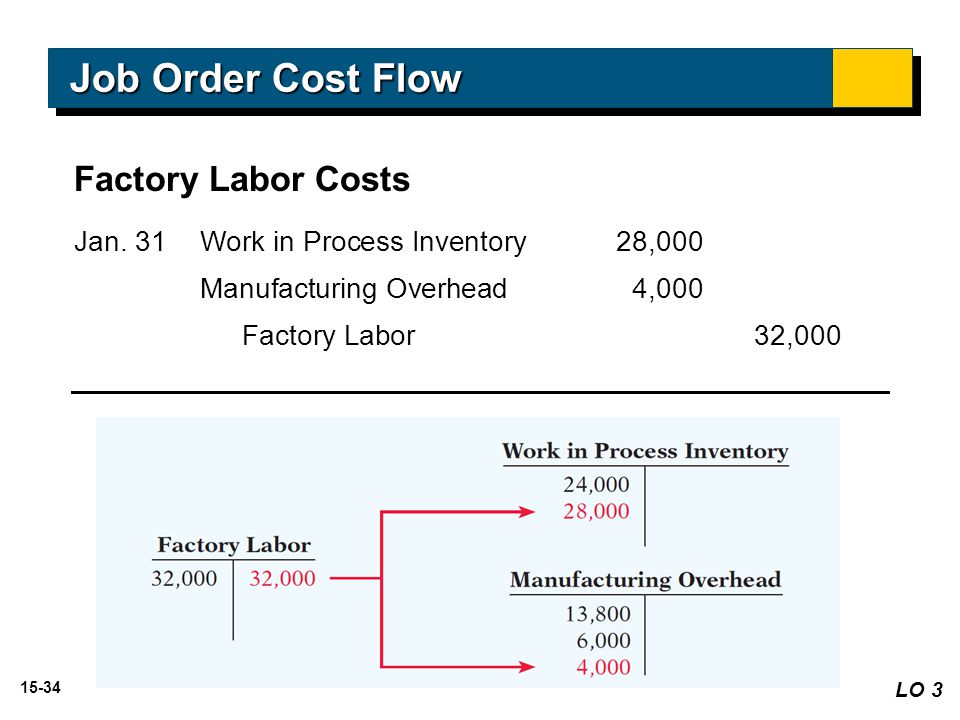

Accounting Fifth Edition Ppt Download

Debit Raw Materials Inventory 195000.

. The employers payroll taxes for the factory payroll are 8000. Debit Work in Process and Credit Wages Payable d. Debit manufacturing overhead cost and credit accounts receivables.

A journal entry that debits manufacturing overhead and credits accounts payable would not be used to record. And finally we credit Accumulated Depreciation for 2500. Prepare the entry to record the factory labor cost for the month of January.

He journal entry to record the direct labor costs for the month would include a debit to Work in Process. Direct labor costs Manufacturing overhead consists of all ______. Then we credit Accounts Payable for the machinery repairs and maintenance utilities and other overhead.

Debit Work in Process and Credit Accounts Payable b. A a debit for standard direct labor quantity for actual production times standard direct labor cost per hour. Work in processes and manufacturing overhead.

Show the journal entry to record the incurrence of direct labor costs. Debit Goods in Process Inventory 195000. Standard hours 53 DLHs per unit.

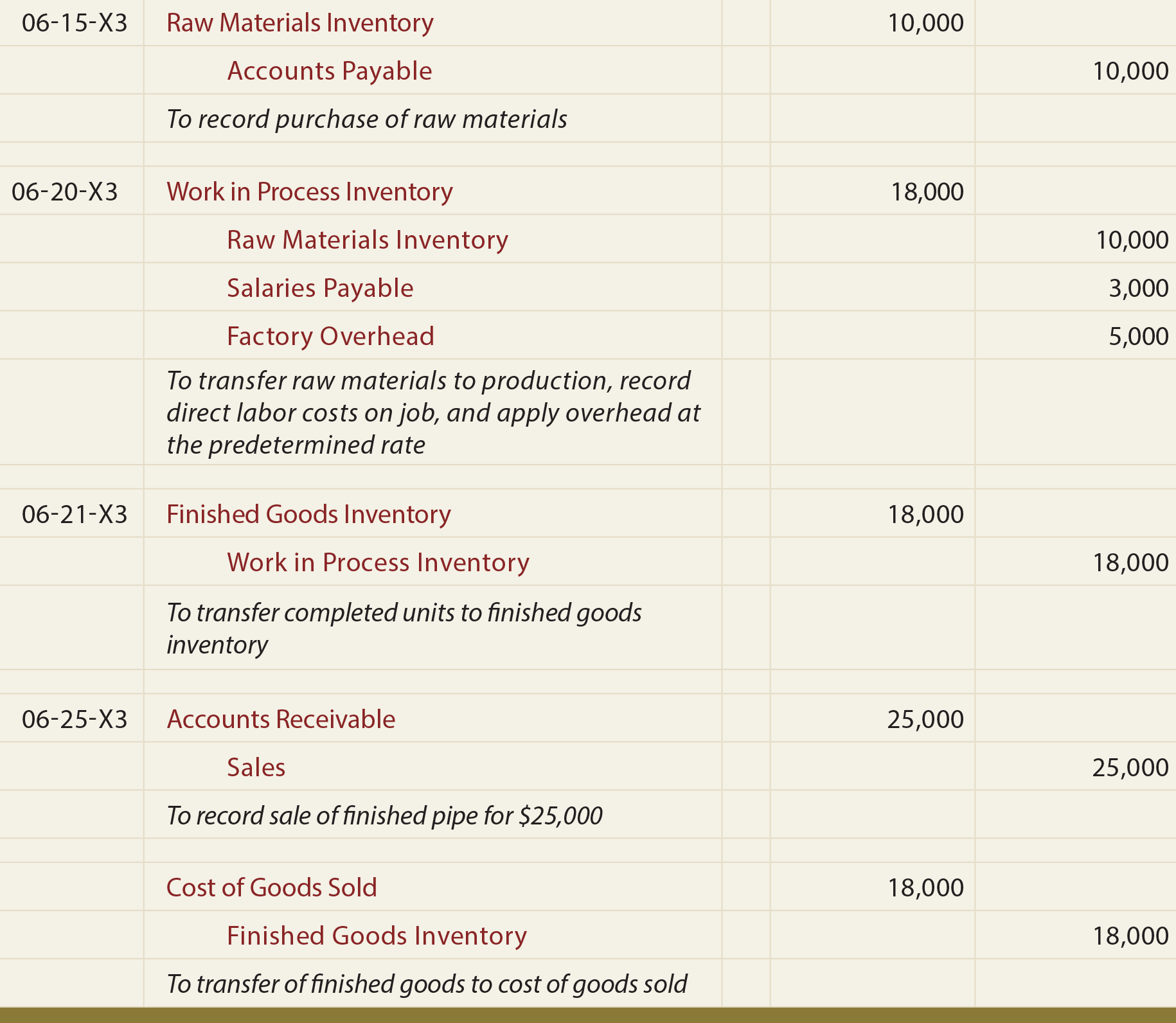

Terms in this set 22 The journal entry to record labor cost credits. B a credit for standard quantity usage for actual production times actual cost per hour. The journal entries follow the job costing process from purchase of raw materials allocation of direct materials direct labor and manufacturing overhead to work in process transfer of the goods through to finished goods and finally to cost of goods sold and sales.

The journal entry to record the actual factory overhead costs incurred is - ScieMce. Asked Sep 25 2015 in Business by Livaco. Initial Purchase When you initially purchase materials for use you record the purchase in the accounting records at cost.

True or false The journal entry to record the use of direct labor includes a from ACCT 729 at Franklin University. The journal entry to record the issuance of materials to production is. If job number 108 incurred 1600 direct labor hours the work in process account will be debited and factory overhead will be credited for.

The journal entry to record the requisition and usage of materials is. He journal entry to record the direct labor costs for the month would include a debit to Work in Process. A journal entry that debits Manufacturing overhead and credits Accounts payable would not be used to record _____.

Credit Raw Materials Inventory 195000. 3 Prepare journal entry to record its other factory overhead costs incurred. The journal entry to record the labor costs is.

Salaries and wages payable 18000 and credits Work in process 10000 and Manufacturing overhead 8000 Salaries and Wages payable 18000 and credits Work in. Debit Accounts Payable and Credit Raw Materials Inventory c. Rice University Openstax CC BY NC SA Direct Labor Paid by All Production Departments.

To prepare the journal entry we debit the Overhead account for the actual costs. As discussed earlier indirect labor is a part of manufacturing overhead and its accounting treatment has been discussed in measuring and. A journal entry debiting cost of goods sold and crediting finished goods is made when.

Factory overhead applied to production was 32000. Journal entry to record direct labor cost. It applies factory overhead at the rate of 140 of direct labor costs.

During the period labor costs incurred on account amounted to 175000 including 150000 for production orders and 25000 for general factory use. Which accounts are debited in the journal entry to record manufacturing labor costs. E2-1 The gross earnings of the factory workers for Vargas Company during the month of January are 66000.

A company spent 2000 on factory rent 1000 on factory utilities and 5000 on misc factory cost. After collecting time tickets by accounting department wages of workers are computed and labor costs are classified as direct or indirect on the basis of information provided by time tickets. Under a standard cost system the journal entry to record direct labor includes ________.

Actual wage rate 1120 per DLH. 1 Prepare journal entry to record its indirect materials requisitioned. The journal entry to record incurred direct labor.

The journal entry to record this transaction debits. Salary and wages payable. During July the shaping department incurred 15000 in direct labor costs and 600 in indirect labor.

We assume an outside contractor does the maintenance and repairs The amount is 4300 3500 1000 1800. Credit Accounts Payable 195000. The journal entry to record labor costs charged to Job 45 is.

Rate of 150 of direct labor cost. Debit Raw Materials Inventory 195000. Pinkney Corporation has provided the following data concerningits direct labor costs for November.

This entry consists of a debit to raw materials inventory and a credit to accounts payable or cash. Standard wage rate 1220 per DLH. Credit Goods in Process Inventory 195000.

Has estimated total factory overhead costs of 190000 and 20000 direct labor hours for the current fiscal year. The fringe benefits to be paid by the employer on this payroll are 6000. The journal entry to record these transactions would be.

2 Prepare journal entry to record its indirect labor used in production. A company incurred 10000 in direct labor costs and 8000 in indirect labor costs.

Management Accounting Ppt Download

Accounting Fifth Edition Ppt Download

Job Costing Material Labor Overhead Principlesofaccounting Com

No comments for "The Journal Entry to Record Labor Costs Credits"

Post a Comment